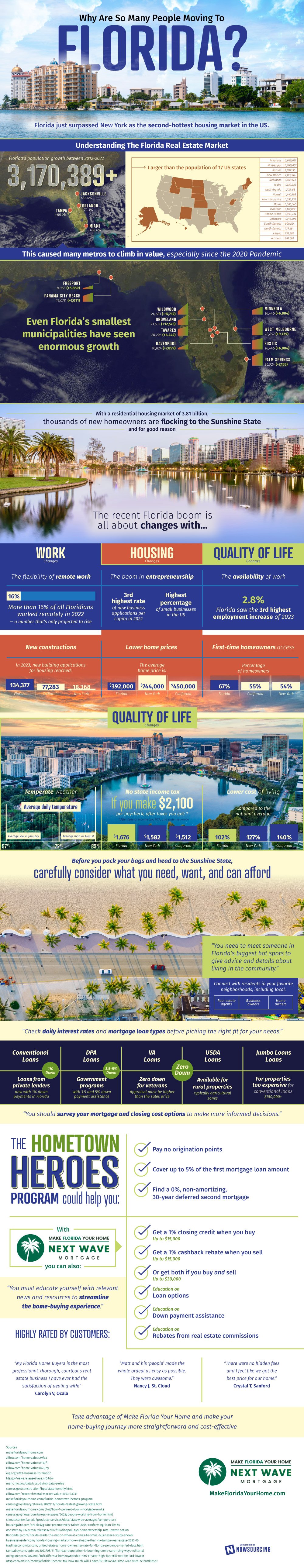

In the past ten years, the Sunshine state has seen a population increase of over 3 million people. From the biggest cities like Tampa and Miami to the smallest municipalities, the value of living in these areas has skyrocketed. Experts speculate that it is for these reasons that Florida just surpassed New York as the second-hottest housing market in the United States. In fact, the residential housing market has just reached a shocking $3.81 billion.

These spikes in numbers have been attributed to some changes in the culture of work in Florida and general quality of life. However, the greatest factors affecting the housing market are the increase in construction interest, lower home prices, and accessibility to homeowners. Especially first-time homeowners, as these residents make up 67% of Florida’s mover population.

When it comes to making a move to the sunshine state, experts advise that movers carefully consider their wants and needs before making any decisions. This is no easy task, which is why there are many programs like Florida credit union mortgage and services dedicated to helping movers with their journey to buying a home. No matter the circumstance, first-time and weathered homeowners can get the help they need, streamlining and removing the stress of the home-buying process. If you’re looking to move to Florida, check out the following infographic below: