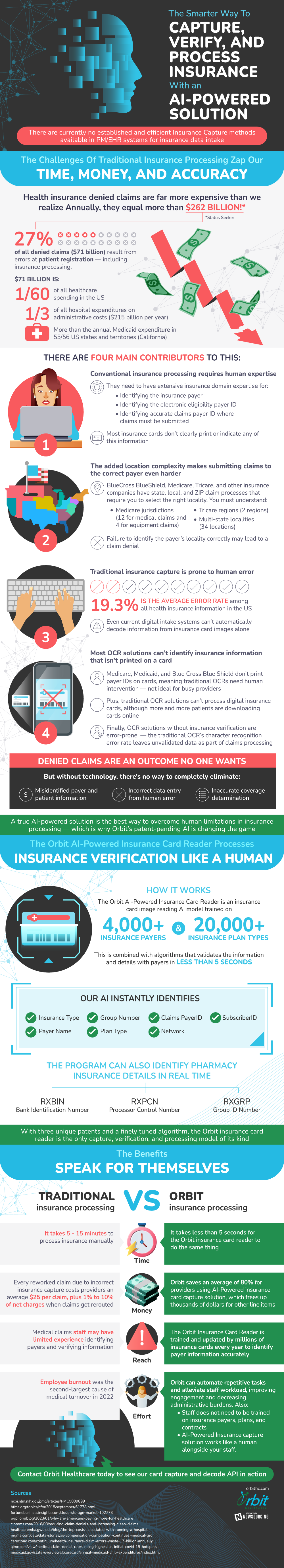

Artificial Intelligence (AI) has the ability to revolutionize the insurance industry, particularly in the sphere of claims processing. There are a lot of current inefficiencies especially in the patient registration process that are causing a whopping $71 billion in losses. This financial deficit is equal to one third of the nation’s total hospital administration costs. By limiting the potential for mistakes with AI technology, hopefully this amount of loss can be drastically reduced.

Errors are common in traditional insurance processing for four main reasons. There are a lot of regulations in place for selecting the right locality. Identifying the wrong one can lead to a denied claim. Patient identification is made difficult due to the lack of specific information on insurance cards. Human error still affects error rates as well, and the current digital systems can’t completely reduce this. Even the OCR software has a lot of shortcomings, especially when processing digital and non-card-based insurance data.

Artificial Intelligence health insurance card capture with API presents itself as a helpful solution. It uses large-scale training on a variety of datasets to improve and speed up insurance information verification. AI is transforming the claims process by verifying vital information like insurance type and claims PayerID in a matter of seconds. Beyond the promise of large cost reductions, the incorporation of AI provides an opportunity for operational correctness and efficiency that will completely change the way insurance claims are processed.

Source: OrbitHC